qOtimp

(Quantum Optimized Timed Portfolio)

Why qOtimp is a Game-Changer in Options Trading?

Options trading can be complex, but innovative App like qOtimp a ground breaking quantum computing product simplify the process by presenting clear, actionable insights. One such feature, the Option Price Summary, provides traders with a comprehensive overview of an option’s fair value, Implied volatility, and critical parameters.

In this blog, we’ll explore how this feature empowers traders to make smarter decisions, highlighting its usability, benefits, and the key financial concepts it encapsulates. Powered by advanced financial modeling algorithms, real-time market data integration through APIs, and an intuitive frontend likely built using frameworks such as Flutter, the app ensures seamless functionality and precise calculations.

How Does qOtimp Differ from the Market?

The app follows the same fundamental principles as traditional options pricing tools but redefines implied volatility. While conventional methods rely on historical data or market-driven assumptions to estimate implied volatility, qOtimp computes it using a standard formula enhanced by the power of quantum computing. This results in:

- Higher Accuracy: Quantum computations reduce errors caused by market noise or assumptions.

- Dynamic Adaptability: The app processes real-time market dynamics with unparalleled speed.

Unlike traditional methods that may struggle with the complexity of variable interdependencies, qOtimp seamlessly handles these calculations, ensuring precise and reliable options pricing.

Why Choose qOtimp for Options Pricing?

- Because It’s Quantum:

- Quantum computing offers a fundamental shift in problem-solving capability. By processing vast amounts of data simultaneously, qOtimp can deliver results that traditional computers can only approximate.

- Enhanced Precision:

- Options pricing is inherently complex and risky due to the volatility and time-sensitive nature of the market. With qOtimp, traders gain access to precise and real-time pricing, reducing uncertainty.

- Future-Ready Technology:

- Traditional computers are reaching their limits in solving high-complexity financial problems. Quantum computing is the next frontier, and qOtimp is leading the charge in applying this technology to trading.

Key Features of qOtimp

- Accurate Fair-Value Pricing

The app calculates the fair-value price of options contracts using advanced financial modeling. By incorporating a unique volatility model, qOtimp ensures that traders pay or receive a fair price for every trade. - Implied Volatility (IV) Insights

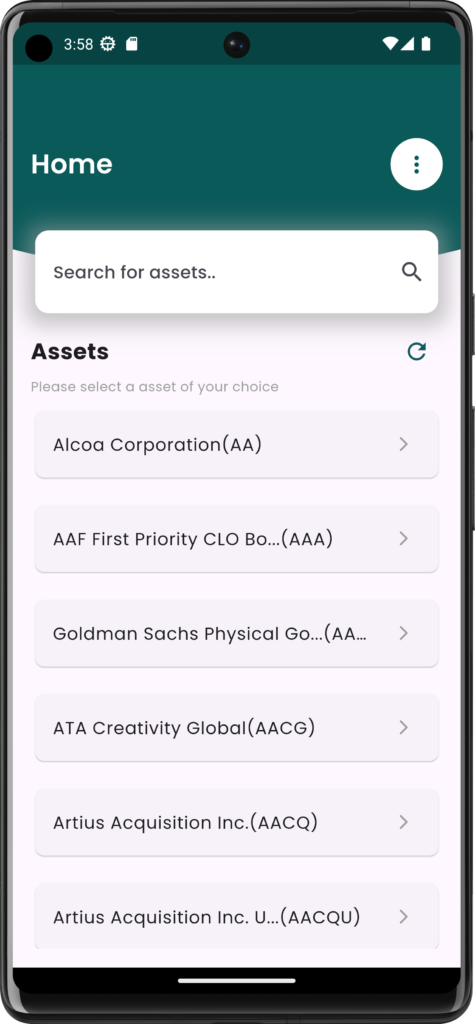

Implied volatility is a cornerstone of options pricing, and qOtimp handles it with precision. Unlike conventional tools, qOtimp’s IV model reflects real-time market nuances, providing traders with a reliable measure of expected price movements. - Dynamic Asset Overview

qOtimp displays essential details about the underlying asset, such as:

Ticker (e.g., “AA” for Alcoa Corporation).

Latest price (e.g., $41.21).

Exchange (e.g., NYSE). This ensures that traders are fully informed before making decisions.

- Call and Put Options

The app allows users to easily select between Call and Put options, tailoring their strategies to market conditions:

Call Option: For betting on price increases.

Put Option: For hedging against potential losses or betting on price decreases.

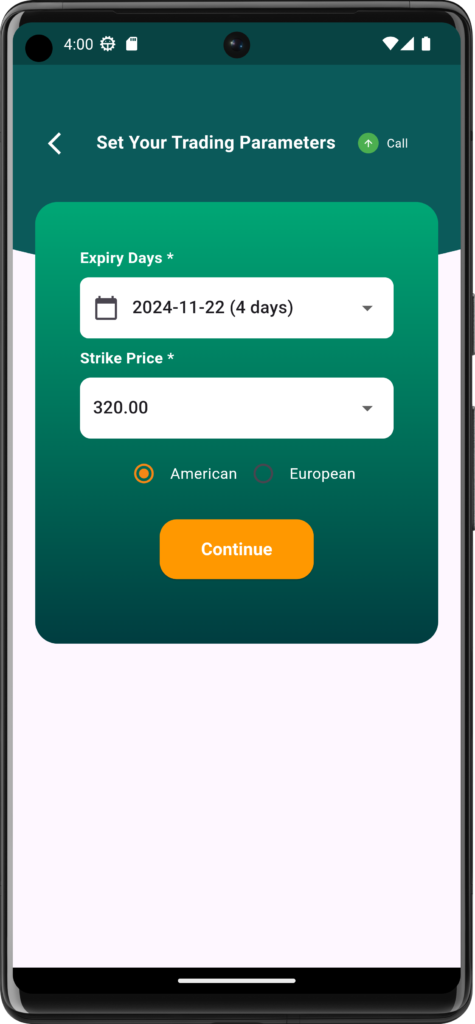

- Flexible Parameter Input

qOtimp offers an intuitive interface for setting trading parameters:

Strike Price: The price at which the option can be exercised.

Expiry Days: The timeframe for the option’s validity.

Option Style: Choose between “American” (exercisable anytime before expiry) or “European” (exercisable only on expiry).

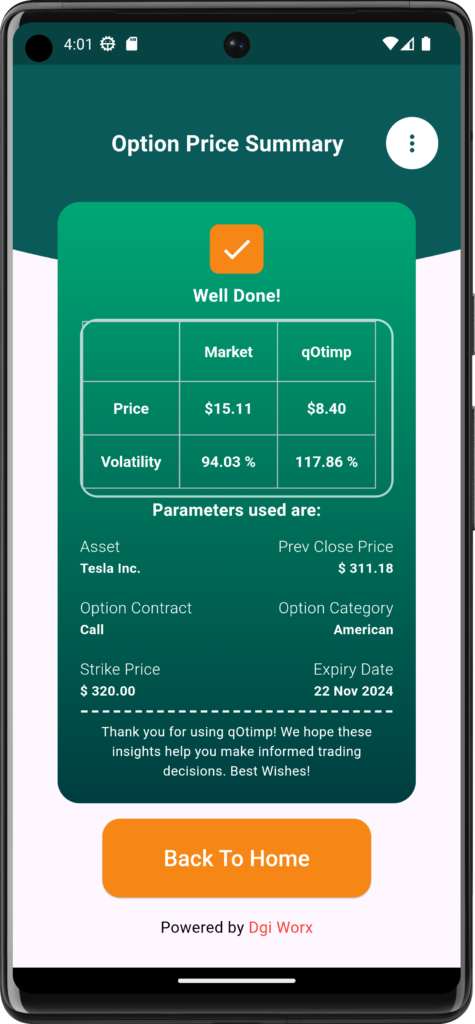

- Comprehensive Option Price Summary

Once the parameters are set, the app generates a detailed summary, including:

Fair-value price of the option.

Implied volatility percentage.

Key contract details (asset name, strike price, expiry date, and more). This summary helps traders evaluate the profitability and risk of their trades at a glance.

Option Price Summary:

Once parameters are set, the app calculates the following:

- Fair-Value Price: The theoretical value of the option based on market data.

- Implied Volatility: A critical metric indicating market expectations of future volatility.

- Parameters Overview: Key details like the asset, strike price, expiry date, and last traded price are summarized for the user.

Real world Usecases:

1.Identifying Profitable Opportunities

A trader notices that Alcoa Corporation’s market price is $41.21 and selects a call option with a strike price of $43. Using the app’s fair-value calculation, they determine if the trade is worth pursuing.

- Managing Risk with Volatility Insights

The app highlights an implied volatility of 142.57%, signaling a potentially high-risk trade. Traders can adjust their strategies accordingly. - Experimenting with Option Types

New traders can experiment with American and European options to understand how their trading flexibility impacts profitability.

Technology behind qOtimp

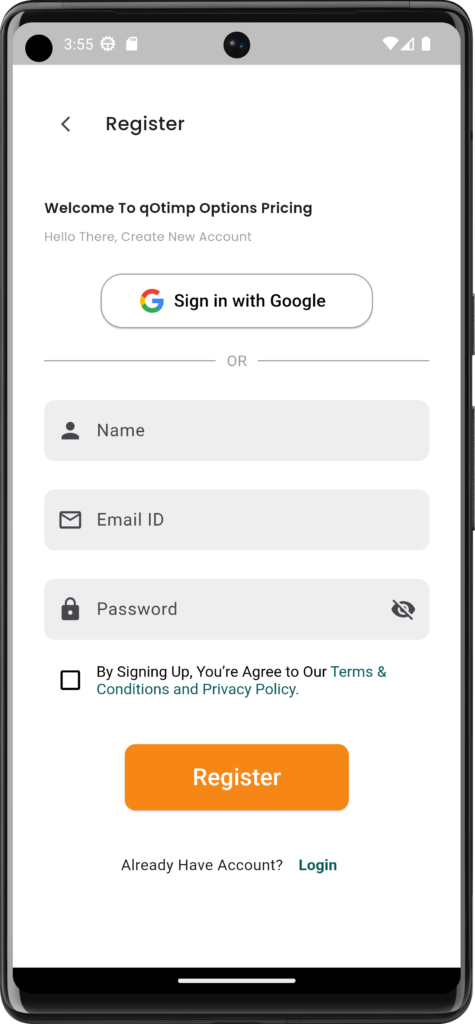

1. Login, Logout, Sign-Up, and Forgot Password

qOtimp ensures a seamless authentication journey:

- Login/Logout:

- A secure session management system ensures data protection.

- Sign-Up:

- New users can quickly create an account through Firebase or Google Sign-In.

- Forgot Password:

- A user-friendly flow powered by Firebase enables secure password recovery in just a few steps.

2 .Flutter for Dynamic UI

qOtimp’s frontend is built using Flutter, a versatile framework known for creating high-performance, cross-platform applications. Key features:

Dynamic Dropdowns:

Dropdowns for strike prices and expiry dates dynamically populate based on the chosen stock.

These are updated in real time using APIs, offering a smooth and responsive user experience.

Intuitive Design:

Flutter ensures a clean and user-friendly interface, making even complex trading actions accessible to beginners.

3.Python FastAPI for Backend Processing

The app’s backend is powered by Python FastAPI, a modern, high-performance web framework. Key functionalities:

Fetching Strike Prices and Expiry Dates:

FastAPI integrates seamlessly with external APIs to fetch and update the strike price and expiry data dynamically.

Processing Options Pricing:

Handles complex computations, including fair-value pricing and implied volatility, with high efficiency.

Scalability:

FastAPI ensures the app can handle multiple user requests simultaneously, even during high traffic periods.

4.Google Sign-In via Firebase

To simplify authentication, qOtimp uses Google Sign-In through Firebase

Secure Login and Sign-Up:

Ensures data integrity and protection by leveraging Firebase’s built-in authentication capabilities.

Ease of Access:

Users can log in with their Google accounts, making the sign-up process quick and hassle-free.

Support for Password Recovery:

Firebase powers the Forgot Password feature, offering a smooth recovery process for users.

5.MySQL for Data Storage

The app uses MySQL for managing all backend data:

Transaction Logs:

Every user transaction (e.g., selected strike prices, expiry dates, completed trades) is stored in a transaction-log database, enabling robust tracking and analysis.

Search Functionality

- A user-friendly search bar is integrated to help traders find specific stocks, strike prices, or expiry dates easily.

- Built with MySQL and backend APIs, the search functionality is fast and responsive, ensuring traders can act without delay.

Conclusion: The Quantum Leap in Trading

qOtimp isn’t just another options pricing tool—it’s a quantum-powered revolution. By combining the precision of quantum computing with real-time data and an intuitive design, qOtimp empowers traders to hedge portfolios, capitalize on market opportunities, and reduce risk like never before.

Whether you’re a seasoned investor or just starting your trading journey, qOtimp provides the tools you need to make smarter, more confident decisions.

Call to Action:

Ready to transform your trading experience? Explore the power of quantum computing with the qOtimp Mobile Application today.

Leave a Reply